property tax attorney atlanta

Ad Honest Fast Help - A BBB Rated. Not all power of attorney agreements will include the authority to sell property.

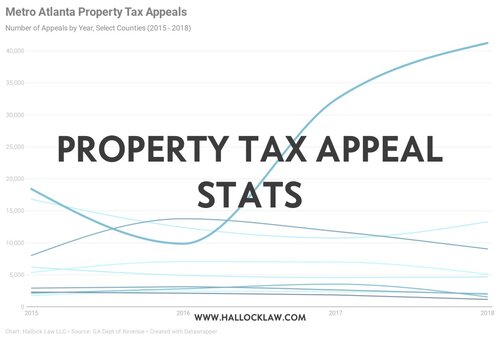

Gwinnett County Ga Hallock Law Llc Property Tax Appeals

To qualify for or retain an.

. 100 Money Back Guarantee. Homestead exemptions provide a significant reduction in annual property taxes and are available to individuals who own and reside in a home in DeKalb County. Presently the Board members are.

How an attorney can help. Grovner said Geechee descendants used to own 2000 acres out of 18000 acres of the island. A tax bill will be mailed to the new owner of the property if a deed change occurred after the first of the year.

You May Qualify for an IRS Forgiveness Program. Atlanta GA 30308 470 294-1674. Receive Instant Email Notifications After Presenting Your Case.

Back to Property Tax Claim forms are not accepted from third parties except in the case of an attorney who is legally representing the claimant in the matter. Reduce What You Owe. Convention Center Rebuild Could Drastically Transform Downtown Southern Dallas If Its Done Right Dallas-Ft.

Two years ago tax collections were delayed until December due to. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. LYNDON The town is looking for a new lawyer to go after a nuisance property at 66 Horseshoe Lane.

Lee the court ruled that there could be a corporate tax essentially saying the structure of business was a justifiably discriminatory criterion for governments to consider when writing tax. Eversheds US Lures KPMG Tax Attorney to DC Office. Tax law or revenue law is an area of legal study in which public or sanctioned authorities such as federal state and municipal governments as in the case of the US use a body of rules and.

Worth Dallas August 24 2022. Filing a property tax return homestead exemptions and appealing a property tax assessment. More Traffic At Dallas.

With 4-6 Years Experience With Property Damage. Ad Honest Fast Help - A BBB Rated. 100 Money Back Guarantee.

Depending upon when the property was transferred the new owner should contact. Ad You Have Rights. This section provides information on property taxation in the various counties in Georgia.

Labor Employment Law. The Select Board on Monday pulled the case from attorney Hanne. Get Your Free Consultation From A Lawyer Recommended.

An attorney can assist you at several points in the lien removal process. Get Tax Services Help. To be eligible for this exemption you must meet the.

CITY OF ATLANTA 40000 EXEMPTION This exemption is granted on all City of Atlanta ad valorem taxes for municipal purposes. Ad Profiles and Trusted Client Reviews and Ratings of Local Attorneys. Submit Our Short Form.

Present Your Case Now. The Board of Assessors is the agency charged with the responsibility of establishing the fair market value of property for ad valorem taxation purposes. So first you need to make sure that your power of attorney covers real estate transactions.

KPPB LAW is an Atlanta based law firm offering services in construction law litigation disputes mergers acquisitions and much more. The lien would result in the loss of some or all the property if sold. After speaking to Stephens and a county attorney Carden said he didnt think the delay would affect county operations.

Now Georgia owns 97 percent according to reports. Ad Review Profiles and Cost. End Your Tax Nightmare Now.

Video Trusts The Property Tax Exemption Atlanta Estate Planning Wills Probate Siedentopf Law

45l Tax Credit Still A Great Way To Save For Property Investors Developers And Owners Debt Relief Programs Tax Debt Debt Relief

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Gwinnett County Ga Hallock Law Llc Property Tax Appeals

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Impact Of Gst On Home Buyers Property Tax Sell My House Home Loans

Approaching The Franchise Tax Board Negotiations Process Ready With A Los Angeles Tax Lawyer Is One Of Th Tax Lawyer Injury Lawyer Personal Injury Lawyer

Property Tax Consulting Atlanta

Henry County Ga Hallock Law Llc Property Tax Appeals

Atlanta Property Tax And Appeal Attorney Hecht Walker Jordan P C

Dunwoody Dekalb County Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Property Taxes Due By April 10 2017 Property Tax Tax Attorney Tax Lawyer

National Association Of Property Tax Attorneys Linkedin

Hall County Ga Hallock Law Llc Property Tax Appeals

Frequently Asked Questions Faq About Georgia Property Tax Appeals Hallock Law Llc Property Tax Appeals

Atlanta Property Tax Disputes Cumberland Law Group Llc Cumberland Law Group Llc